Business Industry Capital

До 31.08.2024 г. можете да ни помогнете да станем по-полезни за Вас!

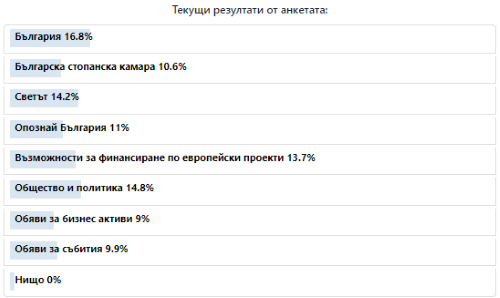

Кои рубрики на "Бизнес Индустрия Капитали" са най-интересни (полезни) за вас:

|

България

|

|  | |

|

Цена: 495 000 EUR

Имотът е на територията на бившия ПУРП Кремиковци АД с Дворно място (с площ 3684 кв. м), и ЕДНОЕТАЖНА АДМИНИСТРАТИВНА СГРАДА (с площ от 576 кв. м) с 26 помещения за канцеларии, две санитарни помещения и коридори.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Валутни курсове

(02.07.2024) |

|---|

| |

EUR |

|

1.95583 |

|

| GBP |

|

2.30668 |

| USD |

|

1.82022 |

| CHF |

|

2.01861 |

| EUR/USD |

|

1.0745* |

|

* определен от ЕЦБ |

|

ОЛП |

| |

от 01.07 |

|

3.63% |

|

|

Цена: 240 000 EUR

3 бр. съседни парцели, с обща площ 59583 кв.м. , нива 5-а категория (възможна промяна), в статут ПИ/поземлен имот.

Локация: срещу бензиностанция OMV (посока Варна) и до бензиностанция OMV (посока София), на около 65 км. преди гр.София

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

|

|

Финансови новини |

|

От първи юли влиза в сила увеличението на пенсиите, което засяга над 2 милиона пенсионери след прилагането на съвкупността от предвидени мерки – осъвременяване на трудовите пенсии с 11 на сто, повишаване на процента на добавката от пенсията на починал съпруг/а, повишаване на минималния размер на пенсията за осигурителен стаж и възраст, определяне на нов по-висок размер на социалната пенсия за старост, повишаване на обвързаните с тях минимални размери на другите видове пенсии и добавки. В Закона за бюджета на държавното обществено осигуряване за 2024 г. са предвидени 1 110,7 млн. лв. (185,1 млн. лв. месечно) за осъвременяването и увеличаването на пенсиите и добавките от 1 юли с 11 на сто. От 1 юли 2024 г. новият минимален размер на пенсията за осигурителен стаж и възраст (чл. 68, ал. 1 и 2 от Кодекса за социално осигуряване) става 580,57 лв. Увеличението е с 11 на сто спрямо размера ѝ до тази дата, който е 523,04 лв. Минималният размер на другите видове пенсии, свързани с трудова дейност (инвалидни, наследствени), се определя като процент от посочения минимален размер на пенсията за осигурителен стаж и възраст. Допълнително увеличение от 1 юли 2024 г. ще получат тези пенсионери, които под формата на добавка към личната си пенсия получават част от пенсията на починалия си съпруг/съпруга. Това са 675 000 души, които получават т.нар. „вдовишка добавка“. Пенсията на починалия, на чиято база се определя добавката, се осъвременява с 11 на сто, но също така се повишава от 26,5 на 30 на сто частта от пенсията, която ще получава преживелият съпруг. От 2011 г. насам това е първото увеличение на процента, който се изплаща от пълния размер на пенсията на починалия съпруг. На увеличение от 1 юли 2024 г. подлежи и размерът на социалната пенсия за старост – от 276,64 лв. на 307,07 лв. Това увеличение се отразява на редица други пенсии и добавки, чиито размери се определят като процент от социалната пенсия за старост – военноинвалидните и гражданскоинвалидните пенсии, персоналните пенсии, добавката за чужда помощ и др. След 1 юли 2024 г. броят на пенсионерите с месечен размер от пенсии и добавки под линията на бедност от 526 лв. намалява от 524 700 на 324 800 души. От Националния статистически институт съобщиха, че дни преди последния срок, малко под половин милион предприятия (495 582) са представили данни за 2023 г., в т.ч. работещи, и "спящи" фирми. Фирмите от втората група имат нулеви приходи и разходи, като вместо отчети за дейността те подават само декларации, че са били неактивни (или че оборотите им за цялата година са били под 500 лв.). Оказва се, че до момента в НСИ са постъпили над 80 000 такива декларации - тоест всяко шесто предприятие в България е било без дейност през миналата година. Показателно е, че всяка година в България се учредяват по 30 000-50 000 нови предприятия, а само 10% от тях оцеляват до втората година. По данни на Агенцията по вписванията, за първата половина на 2023 г. е имало 16 492 производства по ликвидация, които не са приключени, като от тях близо половината - 8170, продължават повече от 5 г. Източник: econ.bg

|

Дружества |

|

Световният производител на бронирани автомобили International Armored Group (IAG), собственост на българския предприемач д-р Антон Стефов, ще открие нов завод в България на 1 октомври 2024 г. в Бургас. В завода ще се произвежда българска отбранителна техника по стандартите на НАТО, с български специалисти. Производствената база е разположена на площ от 150 000 кв.м. в промишлената зона на Бургас. Строежът започна през септември 2023 г. Негов изпълнител е Главболгарстрой - Пловдив. През изминалата година IAG беше сертифицирана като инвеститор клас А, а държавата и общинската администрация на гр. Бургас се ангажираха с изграждането на техническа и довеждаща инфраструктура. Заводът ще произвежда за световните пазари както бронирани машини, така и дронове за спасителни, разузнавателни и аварийни отряди в съдружие с български партньори на IAG. В серийно производство, както в останалите заводи на IAG по света, ще бъдат и военни кранове за евакуация и леки патрулни автомобили. В проект е разработката на колесни и верижни роботи, а в процес на инженерни изчисления - бронирани платформи, носители на леки артилерийски системи. В портфолиото на първия български завод на д-р Антон Стефов се отличава бойната машина на пехотата "Рила 8х8". IAG демонстрира четвъртото й поколение на "Централен артилерийски полигон - МО", където успешно преминаха изпитания по НАТО - STANAG 4569 с ниво на защита от взрив 5а. Стефов отбеляза, че предприятието ще произвежда изделия по най-високите стандарти на НАТО, във време, в което качествената отбранителна техника е от първа необходимост. Първоначалната инвестиция на IAG се очаква да надхвърли 20 милиона лева. Около 50 нови български специалисти ще дадат началото на бъдещото производството, като в хода на работата се очаква да станат най-малко 300. Източник: news.bg

Един участник се е явил на търга за недостроените сгради в Пловдив на „Българска банка за развитие“ (ББР). Държавната банка обяви имотите за продажба през май при начална тръжна цена 33 016 200 лв. без ДДС. В случая става въпрос за поземлен имот в Пловдив с площ 6994 кв.м с няколко недостроени сгради в него. Мястото е до спортна зала „Колодрума“. Сградите са придобити от ББР през 2015 г. от реализирано обезпечение след необслужване на кредит и предприети действия в защита на интересите на ББР. На търга се е явил само един играч – дружеството „Ресурс фонд“ ООД. То е наддало веднъж със съответната стъпка от 660 324 лв. Така е достигната цена 33 676 524 лв. без ДДС. „Ресурс фонд“ е със седалище в София и е с управител Петър Йорданов Господинов. Дялове в дружеството имат три други фирми, както и Петър Господинов като физическо лице. Мажоритарен акционер с дял от над 73% е „Адориа Трейд“ ЕООД, чийто управител и едноличен собственик на капитала е лице с имена Николай Кирилов Димитров. Над 26,4% притежава фирмата „Сентрал Кепитъл Дивелъпмънт“. Дял от 0,18% в „Ресурс фонд“ има „Спортланд“ АД. А Петър Господинов има 0.0012%. Източник: Clubz След решение на министъра на енергетиката и с решение на Съвета на директорите (СД) на „Български Енергиен Холдинг" ЕАД, за изпълнителни директори на холдинга са избрани Валентин Николов и Галина Тодорова. Галина Тодорова е юрист по образование. Тя е с над 15 години опит в енергийния отрасъл и е работила в енергийния отрасъл като директор на Правна дирекция в „Топлофикация София" ЕАД и „Булгартрансгаз" ЕАД. Освободилите своите места от Съвета на директорите на БЕХ ЕАД Иван Андреев и Диян Димитров заемат позиции в Съвета на директорите съответно на „АЕЦ Козлодуй" ЕАД и „ТЕЦ Марица изток 2" ЕАД. От състава на Съвета на директорите на „ТЕЦ Марица изток 2" ЕАД е освободен Живко Динчев. Първият магазин на Lidl в Каварна отвори врати на 29 юни. Така обектите на веригата в цялата страна са вече 129, а населените места, в които присъства - 56. Инвестицията в него е за близо 11,5 млн. лв. Във филиала ще работят 19 души, като през летния сезон броят на служителите ще достигне 36. Акционерите на „Индустриален Капитал Холдинг“ АД са одобрили разпределянето на дивидент в размер на 0,10526 лева на акция бруто на общо събрание, което се е провело на 28 юни. Общата сума, която ще бъде изплатена на акционерите като дивидент, възлиза на малко под 1,7 млн. лева, като идва от печалбата за 2023 г. Близо 1,6 млн. лева са отнесени като неразпределена печалба. Дружеството ще започне да изплаща дивидента от 22 август тази година. Срокът за изплащане на дивидента е шест месеца, т.е. до 22 януари 2025 г. Сумите ще се разплащат чрез „Юробанк България“ (Пощенска банка) и Централния депозитар. Акционерите на „Индустриален Капитал Холдинг“ са освободили от съвета на директорите Димитър Тановски, Иван Делчев, Милко Ангелов, Георги Бочев и Цоко Савов. За нови членове на съвета на директорите са избрани „Дениде“ ООД с управител Иван Делчев, „Профи’ Т“ ООД с управител Димитър Богомилов Тановски, „МАНГ“ ООД, представлявано от Милко Ангелов, както и Анна Милкова Ангелова-Маки, Димитър Димитров Тановски и Деян Иванов Делчев. За независими членове на съвета на директорите са избрани Александър Стефанов, Николай Цветанов, Николай Николов, Източник: investor.bg

Общото събрание на акционерите, "АмонРа Енерджи" АД реши да разпредели на акционерите 1,5 млн. лева дивидент. Сумата за дивидент се формира от печалбата на "АмонРа Енерджи" за 2023 г. в размер на 1 046 970,93 лева и част от неразпределената печалба за минали години в размер на 557 726,16 лева. Като резерв са отнесени 104 697,84 лева, показват още публикуваните на сайта на борсата документи. Това е втората поредна година, в която дружеството разпределя дивидент. През 2023 г. компанията започва да прави доставки на фотоволтаични панели, инвертори и конструкции и от складова база в Шумен. Миналата година "АмонРа Енерджи" придоби основния си дистрибутор в Румъния с цел по-сериозно разширяване на дейността там. Източник: БТА

|

|

Българска стопанска камара

|

|  |

|

Светът

|

|  |

|

Европа |

|

Разширяващата се трансатлантическа пропаст вдъхва радост в САЩ и тревога в Европа. Въпреки че имаха подобни нива на доход на глава от населението преди няколко десетилетия, от 2010 г. растежът е два пъти по-бърз в САЩ, отколкото в Обединеното кралство и големите 4 икономики на ЕС - Германия, Франция, Италия и Испания. Това пише за Financial Times Ручир Шарма, председател на Rockefeller International. Шарма обяснява изоставането на Европа с ролята на правителствата върху капиталистически икономики, чиято намеса се разширява най-забележимо в Европа. До 80-те години на миналия век държавните разходи са средно по-ниски в Обединеното кралство и големите 4 на ЕС, отколкото в САЩ. Сега Европа харчи много повече, отбелязва Шарма, чиято нова книга се казва Какво се обърка с капитализма. „Тежестта на огромната държава смазва растежа на производителността, който е ключ към нарастващия просперитет“, допълва Шарма. Той изчислява, че от следвоенните пикове през 1960 г. растежът на производителността се е сринал от почти 7% до по-малко от нула в големите 4 на ЕС. В САЩ също е спаднал, но по-малко драстично - от 2,5% до около 1%, вероятно благодарение на превъзходството в технологично отношение. Данните за Обединеното кралство започват по-рано. Връщайки се към 1690, Обединеното кралство никога не е имало дефицит в мирно време до 70-те на миналия век, посочва Шарма. След това обаче страната има дефицит през следващите 50 години с изключение на пет от тях. „Революцията“ на Рейгън-Тачър от 80-те години промени само начина, по който държавата финансира своята експанзия, като взема заеми, а не облага с данъци. Публичните дългове са се увеличили трикратно в Обединеното кралство и големите 4 на ЕС до средно около 100% от БВП, отбелязва още авторът, който е ръководил на екипа за развиващи се пазари, а след това е бил и главен глобален стратег в Morgan Stanley Investment Management. По-големите държавни разходи оставят по-малко място за частна конкуренция и инициатива, посочва Шарма. Покупките на облигации и други активи от централните банки са нараснали от почти нула в началото на новото хилядолетие до рекордни висоти през 2020 г., достигайки 16% от БВП в САЩ и 22% в големите 4 на ЕС. „Тъй като „прочистващият ефект“ на рецесиите изчезна, управляващите процъфтяваха. Корпоративните печалби се повишиха отчасти поради олигополното ценообразуване. От 2000 г. продажбите в повечето индустрии се съсредоточават в най-големите компании – по-малко бързо в Европа, отколкото в САЩ, що се касае до този фронт, коментира още Ручир Шарма. Пазарите, които все повече се изкривяват от лесни пари и държавни спасителни мерки, породиха „зомби“ компании, които не печелят достатъчно, за да покрият дори лихвените плащания по дълга си. Последните данни показват, че зомбитата съставляват поне 10% от публичните компании в развитите пазари - до 20% в САЩ и 22% в Обединеното кралство. Това са рядко срещани нива преди 80-те години на миналия век, пише Шарма. Отчасти поради липсата на правомощия за харчене, „еврокрацията“ насочи енергията си към това, което беше описано като „глобален регулаторен хегемон“, продължава Шарма. Всяка компания с амбиции в Европа трябва да отговаря на стандартите, определени от най-мощните държави, Германия и Франция, за всичко - от въглеродните емисии до производството на мляко, отбелязва авторът. Сблъсквайки се както с континенталната, така и с националната бюрокрация, не е изненадващо, че европейците са по-склонни от американците да цитират регулирането като основна пречка за стартиране или разширяване на бизнес. Много от средно големите германски компании казват, че обмислят затваряне, като се позовават на „твърде многото бюрокрация и по-високите данъци“. Много френски компании не смеят да растат, за да не се сблъскат със скъпо струващите правила, които се прилагат за дружества с над 50 служители. Скромният напредък на европейската икономика все още оставя рискове от фискални шокове. Така тежкото регулиране създава бизнес среда, която е благоприятна за мега фирмите с най-много пари и адвокати, посочва Шарма. До удара на пандемията, стартиращите компании намаляваха като дял от всички компании в много индустриални страни, включително Обединеното кралство, Испания и Италия. Като облагодетелстват гигантските компании, правителствата увеличават богатството на основателите на корпорации, включително утвърдени милиардери. Тъй като свръхбогатите притежават лъвския дял от финансовите активи, те печелят най-много, когато държавата се втурне да спре дори незначителни пазарни трусове, коментира Шарма. Те все по-трудно печелят пари там, тъй като растежът на страната се забавя, а натискът от свръхкапацитет се увеличава. През последните десетилетия богатството на милиардерите е нараснало по-бързо като дял от БВП в Обединеното кралство и големите 4 на ЕС, отколкото в САЩ. Сега Франция има както необичайно раздуто правителство, с разходи, равни на 58% от БВП, така и необичайно доминираща милиардерска класа, чието общо богатство се равнява на 22% от БВП, изпреварвайки дори САЩ. Това, по думите на Шарма, осветлява допълнително трансатлантическата пропаст. „Добавете загубите на производителност от олигополи, зомбита, бюрокрация, неравенство и други изкривявания на пазара, подхранвани от голямото правителство, които, взети заедно, биха могли да обяснят забавянето на производителността“, пише той и добавя: „Тежестта на голямото правителство надвишава тласъка от новите технологии, особено в Европа и Обединеното кралство. Обратът е в това, че президентът на САЩ Джо Байдън стимулира дългата експанзия на американските разходи, дълг и регулиране. Дефицитът на страната, доскоро типичен за западна нация, през следващите години се очаква да надхвърли средно над 6% от БВП - много по-високо ниво от Обединеното кралство и Големите 4 на ЕС. Така САЩ са на път да заменят Европа като страната с най-голяма правителствена намеса - и по-бавен растеж. Източник: profit.bg

|

Америка |

|

Добивът на петрол в Канада процъфтява. Производителите увеличават проектите на фона на по-големия достъп до пазара. Проектът за разширение Trans Mountain, който сега е най-накрая завършен и функционира след години на забавяне, променя съдбата на производителите на т.нр. нефтени пясъци в Алберта, като им дава достъп до пазари в Азия и Западното крайбрежие на САЩ, пише Oilprice. Ограничен в продължение на години канадският петрол сега има близо 600 000 барела на ден (bpd) допълнителен пазарен достъп. Разширеният тръбопровод Trans Mountain утроява капацитета на първоначалния тръбопровод до 890 000 барела на ден от 300 000 барела на ден за пренос на суров петрол от Алберта до Британска Колумбия на тихоокеанското крайбрежие. Производителите се възползват от това. Те започнаха да увеличават производството в края на миналата година в очакване на началото на Trans Mountain Expansion (TMX) през първата половина на тази година. Увеличаването на производството на нефтените пясъци е резултат от разширяването на оперативни проекти със съществуваща инфраструктура, така че капиталовите разходи, които са много високи за този вид добив на суров петрол, са по-ниски, отколкото при изграждане на проекти от нулата. Нарастването на добива на петролните пясъци в Канада, най-вече благодарение на Trans Mountain Expansion, превръща страната в една от страните с най-голям принос извън ОПЕК+ за нарастващото глобално предлагане тази година, заедно със Съединените щати, Гвиана и Бразилия. Според някои прогнози на анализатори Канада може да бъде най-голям източник на растеж на доставките на петрол, като дори да изпревари САЩ или Гвиана. "С изключение на всякакви непредвидени обстоятелства, Канада може да бъде най-големият източник на увеличени доставки на петрол в света през 2024 г.", смята Марк Ерколао, икономист в TD Economics, посочено в доклад от тази година. Тази година ръстът на добива в Канада може да бъде между 300 000 - 500 000 барела на ден, "поставяйки страната в надпревара за най-големия източник на растеж на глобалните доставки на петрол", каза Ерколао. Прогнозите за растеж на глобалните доставки на петрол варират, но канадският може да представлява 25-67% от допълнителните доставки през 2024 г., отбеляза икономистът. Trans Mountain Expansion се очаква да повиши цената на тежкия суров петрол в Канада за години напред, казват ръководители на големите енергийни компании. Производството на суров петрол расте в Западна Канада, като Алберта достигна рекордно високо производство от 4,53 милиона барела на ден през декември 2023 г. TMX може да увеличи общия капацитет на тръбопроводите за износ на суров петрол в Западна Канада с 13%, помагайки за облекчаване на ограниченията на капацитета на тръбопроводите за износ, отбеляза регулаторът миналия месец. Като цяло капацитетът на тръбопровода Trans Mountain ще представлява 17% от общия капацитет за износ на тръбопроводи, наличен за канадските превозвачи на суров петрол. Акциите на четирите най-големи производители на петролни пясъци в Канада отбелязаха ръст от 37% през последните 12 месеца, а индексът на най-големите петролни и газови компании в САЩ изостана от този ръст с 19 процентни пункта. Въпреки че проектите за нефтени пясъци са по-скъпи и се нуждаят от години за стартиране, те могат да изпомпват суров петрол в продължение на години и десетилетия, за разлика от шистовите образувания в САЩ. Източник: money.bg

|

Азия |

|

Китай публикува списък с правила, касаещи редкоземните елементи. Те са насочени към защита на доставките за целите на националната сигурност, информира Ройтерс. В правилата са изложени начините за търговия, добив и топене на критично важните материали, използвани за производството на продукция от магнити в електрически превозни средства (електромобили) за потребителската електроника. Държавният съвет или кабинетът на Китай заяви, че редкоземните ресурси са собственост на държавата. Както и, че правителството ще наблюдава развитието на индустрията за редкоземни елементи - група от 17 минерала, в производството, на които Китай се превърна в световен лидер в през последните години. На страната се пада дял от почти 90% от световното производство по рафиниране. Глобалното значение на редкоземните елементи за индустрията е такова, че съгласно законодателството, което влезе в сила през месец май, ЕС си постави амбициозни цели за 2030 г. за вътрешно производство на минерали, които са от решаващо значение за зеления преход. Това се дължи главно на факта, че те се използват в постоянните магнити, които захранват двигателите на електрически превозни средства и във вятърната енергетика. Според прогнозите, европейското търсене ще нарасне 6 пъти в периода до 2030 г. и 7 пъти към 2050 г. Новите китайски правила, които влизат в сила от 1 октомври предвиждат Държавният съвет да създаде информационна система за проследяване на редкоземните минерали. Предприятията, занимаващи се с добив, топене и отделяне на редкоземни елементи и износ на продукти от редкоземни елементи, трябва да създадат система за отчитане на продуктовия поток и трябва „вярно“ да фиксират този поток и да го въвеждат в системата за проследяване, казва Държавният съвет. През миналата година Китай вече въведе ограничения за експорта на германий и галий широко използвани в сектора за производство на чипове. Властите се позоваха на необходимостта от защита на националната сигурност и интереси. Освен това Китай забрани износа на технология за редкоземни магнити и също забрани технологиите за извличане и разделяне на редкоземни метали. Правилата подхранват опасенията, че ограниченията върху доставките на редки земни елементи могат да засилят напрежението със Запада, особено със Съединените щати, които обвиняват Китай, че използва икономическа принуда, за да повлияе на други страни. Пекин отрича тези обвинения. Докато Китай въвежда разпоредби относно редкоземните елементи, ЕС се готви да наложи предварителни тарифи върху китайските електромобили от 4 юли. Целта е да се предпази от наплив от електрически превозни средства, произведени с несправедливи държавни субсидии, въпреки че и двете страни заявиха, че планират да договорят предложените тарифи.

|

|

Индекси на фондови борси

28.06.2024 |

| Dow Jones Industrial |

| 39 171.00 |

(33.00) |

| Nasdaq Composite |

| 17 732.60 |

(-126.08) |

Стокови борси

28.06.2024 |

|---|

| |

Стока |

Цена |

|

| Light crude ($US/bbl.) | 81.46 |

| Heating oil ($US/gal.) | 2.6010 |

| Natural gas ($US/mmbtu) | 2.7380 |

| Unleaded gas ($US/gal.) | 2.5634 |

| Gold ($US/Troy Oz.) | 2 336.90 |

| Silver ($US/Troy Oz.) | 29.29 |

| Platinum ($US/Troy Oz.) | 1 004.00 |

| Hogs (cents/lb.) | 89.58 |

| Live cattle (cents/lb.) | 185.43 |

|

|

|

Природен резерват Ропотамо |

|

Резерватът Ропотамо е обособен през 1992 на площ от 1000,7 ха около двата бряга на едноименната река. Включва в себе си съществуващите преди това природен парк “Ропотамо” (резерват “Водни лилии”), резерватите “Змийски остров”, “Аркутино” и “Морски пелин”. При вливането на р. Ропотамо в Черно море се е образувал лиман, като в него навлиза и морска вода. Има формирани блатисти местности с ясенова гора с лонгозен характер и съобщества от водни лилии. Флората и фауната включват редки и застрашени от изчезване видове, което го прави природен комплекс с международно значение. Река Ропотамо е кръстена на гръцката богиня Ро (Rо на гръцки означава “бягам”, а potamo означава “река”), която, с песните си и красотата си, е спечелила милостта на пиратите, които са тероризирали древна Аполония. Реката тече през гъста гора от широколистни дървета, като корените и долната част от стъблата на голяма част от дърветата с потопени във водата. Избуяли треви, тръстики и лианообразни влачещи се бръшляни създават у човек усещането, че се намира в джунгла. Последните седем километра от реката съдържат над 100 растителни вида, включени в Червената книга на защитените видове в България.

Местоположение

|

|

Архив

Бизнес Индустрия Капитали |

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив