Business Industry Capital

До 31.08.2024 г. можете да ни помогнете да станем по-полезни за Вас!

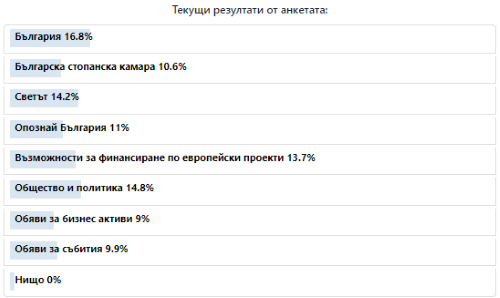

Кои рубрики на "Бизнес Индустрия Капитали" са най-интересни (полезни) за вас:

|

България

|

|  | |

|

Цена: 495 000 EUR

Имотът е на територията на бившия ПУРП Кремиковци АД с Дворно място (с площ 3684 кв. м), и ЕДНОЕТАЖНА АДМИНИСТРАТИВНА СГРАДА (с площ от 576 кв. м) с 26 помещения за канцеларии, две санитарни помещения и коридори.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Валутни курсове

(04.07.2024) |

|---|

| |

EUR |

|

1.95583 |

|

| GBP |

|

2.30967 |

| USD |

|

1.81802 |

| CHF |

|

2.01258 |

| EUR/USD |

|

1.0758* |

|

* определен от ЕЦБ |

|

ОЛП |

| |

от 01.07 |

|

3.63% |

|

|

Цена: 240 000 EUR

3 бр. съседни парцели, с обща площ 59583 кв.м. , нива 5-а категория (възможна промяна), в статут ПИ/поземлен имот.

Локация: срещу бензиностанция OMV (посока Варна) и до бензиностанция OMV (посока София), на около 65 км. преди гр.София

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

|

|

Финансови новини |

|

През 2023 г. относителният дял на разходите за пенсии от БВП е 10,4%, като тук са включени и изплатените допълнителни суми към пенсиите. В сравнение с 2022 г. стойността на показателя бележи увеличение с 1,1 процентни пункта. Броят на пенсионерите към 31 декември 2023 г. е 2 037 336, като спрямо 31 декември 2022 г. той се e увеличил със 7 018 (0,3%). Средният месечен размер на пенсията на един пенсионер за 2023 г. е 784,48 лв. При неговото изчисляване са взети предвид всички добавки към пенсиите по Кодекса за социално осигуряване (КСО), както и изплатената през 2023 г. т.нар. „великденска добавка“ в размер на 70 лв. Номиналното нарастване на средния месечен размер на пенсиите е 16,3%, а реалното - 7,1%. Средногодишният хармонизиран индекс на потребителските цени за 2023 г. е 8,6%. През 2023 г. брутният и нетният коефициент на заместване на дохода са съответно 54,3% и 69,9%. Отчетените общо разходи за пенсии през 2023 г. са в размер на 19 123 241,0 хил. лв. при планирани 19 168 164,5 хил. лв. Отчетените средства са с 44 923,5 хил. лв. или 0,2% по-малко от планираните и с 3 488 526,4 хил. лв.(22,3%) повече в сравнение с изразходваните през 2022 г. Източник: НСИ

Според класификацията на Световната банка България за първи път попада в групата на страните с висок национален доход. Групата на Световната банка разпределя икономиките в света в четири групи по доход: нисък, нисък-среден, висок-среден и висок. Класификациите се актуализират всяка година на 1 юли въз основа на Брутен национален доход (БНД) на глава от населението за предходната календарна година. Тази година три държави - България, Палау и Русия - преминаха от категорията на държавите с по-висок среден доход в категорията на държавите с висок доход. Страната ни влиза в тази група за първи път, а Русия е била там през периода 2012-2014 г. Според Световната банка брутният национален доход (БНД) на глава от населението в Русия е бил 14 250 долара, толкова е имал Палау, а преди тях е България с 14 460 долара. България постоянно се приближава към прага на високите доходи със скромен растеж през целия период на възстановяване след пандемията, който продължава и през 2023 г., когато реалният БВП нараства с 1,8%, подкрепен от потребителското търсене. Икономическата активност в Русия бе повлияна от голямото увеличение на свързаните с военната дейност дейности през 2023 г., а растежът бе стимулиран и от оживлението в търговията (+6,8%), финансовия сектор (+8,7%) и строителството (+6,6%). Тези фактори доведоха до увеличение както на реалния (3,6%), така и на номиналния (10,9%) БВП, а БНД на глава от населението на Русия нарасна с 11,2%. Източник: econ.bg

|

Дружества |

|

На 28 юни бе осъществен първият жп курс на частната компания ТБД Товарни превози, която инвестира над 6 000 000 евро в нов подвижен състав. Благодарение на това сериозно капиталовложение частният жп оператор ще може да извършва регулярни доставки на биомаса от различни доставчици до техните клиенти целогодишно. Първият жп курс бе реализиран по жп отсечката от гара Долна Митрополия до гара Голямо село - ТЕЦ Бобов Дол. Товарната композиция се състоеше от 19 вагона, всеки от които натоварен с над 13 тона слама, изцяло добита от български производители. Очаква се обичайните курсове на жп оператора да се осъществяват с до 40 натоварени с чиста биомаса вагони, като така дължината на товарната композиция заедно с локомотива ще е приблизително 600 метра. Най-голямата енергийна централа в Югозападна България ТЕЦ Бобов Дол преди няколко години включи биомаса в своя горивен микс като част от своята дългосрочна стратегия за премахване на въглищата и постепенно преминаване към нискоемисионни източници на енергия. Експертите на дружеството нееднократно са обяснявали открито, че изгарянето на биомаса не отделя въглеродни емисии и са отбелязвали, че основно се използва обикновена слама, както и слънчогледови люспи и пелети. За обезпечаване на поетия ангажимент към няколко енергийни дружества за транспортиране на биомаса, ТБД Товарни превози са инвестирали в 3 локомотива и над 140 специализирани вагони, пригодени за товарене на бали и голямо тонажни контейнери. Компанията „ТБД Товарни превози“ е със седалище в гр. Перник и притежава лиценз за жп оператор от 2015 година. От тогава до сега частният жп оператор непрекъснато разширява обема от доставки, които извършва. Основните клиенти на дружеството са български топлофикации, като до момента извършваните курсове бяха за транспортиране на въглища и кварцов пясък директно от мините до няколко ТЕЦ в страната, както и до почти всички стъкларски заводи в България и Румъния. Източник: Блиц

Датската компания за видеотехнологии Milestone Systems, която има развоен център в София, обяви, че се слива с щатския доставчик на облачни решения за видеонаблюдение Arcules. По този начин двете компании целят да обединят на едно място услугите на Milestone и Arcules в софтуера за видеомениджмънт (VMS), видеоанализи и видеонаблюдение като услуга (VSaaS). Планира се сливането да бъде завършено до края на тази година. В България Milestone Systems отваря офис през февруари 2011 г., първоначално стартирайки като R&D център, но заради потенциала на българския пазар за специалисти скоро компанията започва да развива и други функции. Към момента в тукашното звено работят над 200 служители в различни технически и нетехнически отдели, които формират целия бизнес цикъл на разработка, поддръжка и продажби на софтуер. Всъщност офисът в София е вторият по големина за развойна дейност след централата в Копенхаген, Дания, и основен хъб за управление на продажбите в Централна и Източна Европа. Приходите на българското дружество "Майлстоун Системс България" за 2022 г. постоянно растат, като за 2022 г. достигат 23.3 млн. лв. С централа в Ървайн, Калифорния, САЩ, Arcules е отделена от Milestone през 2017 г. Решението компаниите да се обединят отново е движено от обща визия за доставка на интелигентна, базирана на данни видеотехнология, която дава възможност на клиентите да вземат по-добри решения и да оптимизират своите операции. „Хамбергер България“ открива ново производство в Ловеч, като е наета сграда от 2000 кв. м в района на бившата „Сердика“, където до края на юли ще започнат работа първите до 50 души. Намеренията са бройката заети да стигне постепенно 100. В Ловеч германската компания ще произвежда обзавеждане за баня. Инвестицията в Ловеч е първото изнесено производство на „Хамбергер България“, която оперира на българския пазар от 2003 г. "Хамбергер България" е част германската група Hamberger, позната у нас с основното си производство на седалки за тоалетни чинии в Севлиево. Дървопреработвателното предприятие "Фореста мебел" в Габрово, изпълнява производствената си дейност в сгради, разположени върху близо 3 декара застроена площ. Компанията изработва мебели по поръчка на клиента. За последните три години компанията е инвестирала около 250 хил. лева за развитие на бизнеса - за покупка на нови циркуляри и CNC машини, за по-добри условия на труд за персонала, за енергийна ефективност. Заетите във фирмата са 11, за 2022 г. "Фореста мебел" отчита 23% ръст на приходите, които достигат 650 хил. лева. Компанията планира закупуването на още една CNC машина и развитие на идеята за собствени модели серийни мебели. Рекордните 7,2 млн. тона товари е обработил през 2023 г. БМФ Порт Бургас - основен оператор на пристанището в града. Това са 130 000 десетфунтови еквивалентни единици (TEU) - стандартният за индустрията размер на контейнер. Само преди десетилетие - през 2013 г., обработените TEU са били едва 46 000. Този ръст нови на дружеството над 50-процентов пазарен дял у нас. БМФ Порт Бургас е и най-големият работодател в региона. На пристанището в момента се работи по изграждането на първото в България дълбоководно корабно място за контейнеровози, оборудвано за обработка на специализирани кораби Panamax. Името идва от размерите им - максималните допустими за преминаване през Панамския канал. Говорим за плавателни съдове с дължина от над 290 метра и ширина от над 30 метра, които сами по себе си пренасят хиляди TEU. Корабното място трябва да стане готово през 2025 г. Източник: money.bg

„Доверие Обединен Холдинг“ АД върви към затваряне на дъщерното дружество „Доверие – грижа“ ЕАД, което произвежда перилните и почистващи препарати Easy. Предприятието за производство на перилни и почистващи препарати Easy се намира в Троян. „Доверие Обединен Холдинг“ придоби производителя с предишно наименование „Веко“ ЕООД през 2017 г. Според последния публикуван отчет в Търговския регистър за 2022 г. „Доверие – грижа“ отчита загуба в размер на почти 1,7 млн. лева в сравнение със загуба за над 2,5 млн. лева, реализирана през 2021 г., над 2,8 млн. лева през 2020 г. и над 3,3 млн. лева през 2019 г., т.е. има тенденция на спад на загубите. Дружеството обаче е декапитализирано заради натрупани загуби за над 13 млн. лева към края на 2022 г. Източник: investor.bg

|

|

Българска стопанска камара

|

|  |

|

Светът

|

|  |

|

Европа |

|

Европейската комисия обяви шестия инвестиционен пакет в рамките на икономическия и инвестиционен план на ЕС за Западните Балкани. Очаква се новият пакет да мобилизира 1,2 милиарда евро инвестиции, информира официалният сайт на ЕК. В рамките му ще бъдат подкрепени осем нови водещи инвестиции във водоснабдяването и канализацията, пречистването на отпадни води и железопътния транспорт, както и иновации и зелена трансформация в малките и средни предприятия. Предвижда се инвестициите да бъдат реализирани в тясно сътрудничество с партньорите от Западните Балкани и международните финансови институции. Инвестиционният пакет от 1,2 милиарда евро включва 300 милиона евро безвъзмездни средства от ЕС от Инструмента за предприсъединителна помощ (IPA III), допълнителни двустранни вноски от държавите членки на ЕС и Норвегия, заеми от международни финансови институции и принос от икономиките на страните от Западните Балкани. Досега ЕС е одобрил програми, които се очаква да мобилизират до 17,5 млрд. евро в инвестиции по Икономическия и инвестиционен план, включително 5,4 млрд. евро безвъзмездна европейска помощ. Източник: Агенция Фокус

|

Америка |

|

Правителствата по света дължат безпрецедентните 91 трилиона долара - сума почти равна на размера на глобалната икономика и такава, която в крайна сметка ще нанесе тежки жертви на населенията. Дълговото бреме стана толкова голямо, отчасти зарадии цената на пандемията, че сега представлява нарастваща заплаха за жизнения стандарт дори в богатите икономики, включително в САЩ, пише CNN Business. И все пак, в година на избори по света, политиците до голяма степен пренебрегват проблема, не желаят да рискуват избирателите си като увеличат данъци и им е все по-трудно да съкратят разходите, необходими за справяне с потопа от заеми, който са натрупали. В някои случаи те дори дават разточителни обещания, които най-малкото биха могли отново да увеличат инфлацията и дори да предизвикат нова финансова криза. Миналата седмица Международният валутен фонд повтори предупреждението си, че "хроничните фискални дефицити" в САЩ трябва да бъдат "спешно разгледани". Инвеститорите отдавна споделят това безпокойство относно дългосрочната траектория на финансите на американското правителство. С нарастването на дълговата тежест по света, инвеститорите нарастват безпокойството. Във Франция политическите сътресения изостриха опасенията относно дълга на страната, като повишиха доходността на облигациите или възвръщаемостта, изисквана от инвеститорите. Първият тур на предсрочните избори в неделя показа, че някои от най-лошите страхове на пазара може да не се сбъднат. Но дори и без призрака на незабавна финансова криза, инвеститорите изискват по-висока доходност, за да купят дълга на много правителства, тъй като недостигът между разходите и данъците се увеличава. По-високите разходи за обслужване на дълга означават по-малко налични пари за важни обществени услуги или за реагиране на кризи като финансови сривове, пандемии или войни. Тъй като доходността на държавните облигации се използва за ценообразуване на други дългове, като ипотеки, нарастващата доходност също означава по-високи разходи по заеми за домакинствата и бизнеса, което вреди на икономическия растеж. С нарастването на лихвените проценти частните инвестиции намаляват и правителствата са по-малко способни да вземат заеми, за да отговорят на икономическия спад. Справянето с проблема с дълга на Америка ще изисква или повишаване на данъците, или съкращения на обезщетения, като програми за социално осигуряване и здравно осигуряване</em>", коментира Карън Дайнън, бивш главен икономист в Министерството на финансите на САЩ, днес професор в Harvard Kennedy School. Много политици просто не желаят да говорят за трудните избори, които ще трябва да бъдат направени. Това са много сериозни решения и те могат да бъдат много важни за живота на хората. През 2010 г. много академици, политици и централни банкери стигнаха до мнението, че лихвените проценти просто ще бъдат близо до нула завинаги и след това започнаха да мислят, че дългът е безплатен обяд. Това винаги е било погрешно, защото можете да мислите за държавния дълг като за притежаване на ипотека с гъвкав лихвен процент и ако лихвените проценти се покачат рязко, вашите лихвени плащания се увеличават много. И точно това се случи по целия свят. В Съединените щати Федералното правителство ще похарчи 892 милиарда долара през текущата фискална година за лихвени плащания - повече, отколкото е предвидило за отбрана и доближаване до бюджета за здравно осигуряване за възрастни хора и хора с увреждания. Следващата година лихвените плащания ще надхвърлят 1 трилион долара по държавния дълг от над 30 трилиона долара, което само по себе си е сума, приблизително равна на размера на икономиката на САЩ, според Бюджетната служба на Конгреса, фискалният надзорен орган на Конгреса. CBO предвижда дългът на САЩ да достигне 122% от БВП само след 10 години. А през 2054 година дългът се очаква да достигне 166% от БВП, забавяйки икономическия растеж. Икономистите не смятат, че има "предварително определено ниво, на което се случват лоши неща на пазарите", но повечето смятат, че ако дългът достигне 150% или 180% от брутния вътрешен продукт. Въпреки нарастващата тревога относно купчината дългове на федералното правителство, нито Джо Байдън, нито Доналд Тръмп, основните кандидати за президент през 2024 г., обещават фискална дисциплина преди изборите. Британските политици също заровиха главите си в пясъка преди общите избори в четвъртък. Институтът за фискални изследвания, влиятелен мозъчен тръст, осъди "заговор за мълчание" между двете основни политически партии в страната заради лошото състояние на публичните финанси."Независимо кой ще поеме длъжността след общите избори, те - освен ако не извадят късмет - скоро ще се изправят пред тежък избор", смята директорът на IFS Пол Джонсън. Увеличете данъците с повече, отколкото са ни казали в своите манифести, или приложете съкращения в някои области на разходите, или вземете повече заеми и бъдете доволни дългът да расте за по-дълго време. Държавите, които се опитват да се справят с проблема с дълга, се борят наистина. В Германия, която е най-голямата европейска икономика, продължаващите вътрешни борби за лимитите на дълга поставиха тристранната управляваща коалиция на страната под огромно напрежение. Политическото противопоставяне може да достигне връх този месец. Но проблемът с отлагането на усилията за овладяване на дълга е, че прави правителствата уязвими на много по-болезнено дисциплиниране от финансовите пазари. Обединеното кралство е най-пресният пример за голяма икономика. Бившият премиер Лиз Тръс предизвика срив на паунда през 2022 г., когато се опита да прокара големи данъчни облекчения, финансирани чрез увеличени заеми. И заплахата не е изчезнала. Рискът от финансова криза във Франция стана сериозно безпокойство буквално за една нощ, след като президентът Еманюел Макрон свика предсрочни избори миналия месец. Инвеститорите се притесняваха, че гласоподавателите ще изберат парламент от популисти, решени да харчат повече и да намалят данъците, което допълнително ще увеличи вече високия дълг и бюджетния дефицит на страната. Въпреки че този най-лош сценарий сега изглежда по-малко вероятен, това, което ще се случи след втория тур на гласуването следващата неделя, далеч не е сигурно. Доходността на френските държавни облигации продължи да се покачва, достигайки най-високото си ниво от осем месеца насам. Всичко това ни показва ясно, че, че финансовите пазари могат бързо да се "изнервят" от дадена политическа осбтановка, която кара инвеститорите да се съмняват в желанието на правителствата да изплащат дълговете си. Източник: money.bg

|

Азия |

|

Зависимостта на Филипините от въглищна енергия е нараснала до 62% миналата година, с което островната страна изпреварва Китай, Индонезия и Полша по този показател, съобщава CNBC, цитирайки изследване на базирания в Лондон енергиен мозъчен тръст Ember. Филипините са и най-зависимата от въглища страна в Югоизточна Азия през 2023 г., тъй като темпът на налагане на електроенергия от възобновяеми източници остава слаб. Делът на произведената електроенергия от въглища в страната се покачва до 61,9% през миналата година спрямо 59,1% през 2022 г. Като цяло производството на въглища в страната също се е повишило с 9,7%, което е повече от 4,6-те процента увеличение на търсенето на електроенергия, се посочва в доклада на Ember. „Въглищата изиграха важна роля в енергийната сигурност на Филипините. През 90-те години (на миналия век) бяха изградени много нови въглищни електроцентрали, за да отговорят на нарастващото търсене на електричество“, изтъква пред CNBC Динита Сетявати, старши анализатор на електроенергийната политика за Югоизточна Азия в Ember Climate. „Индонезия и Филипините са двете най-зависими от въглищата държави в Югоизточна Азия и тяхната зависимост нараства бързо“, посочва мозъчният тръст, добавяйки, че регионът на Югоизточна Азия е отбелязал ръст от 2 процентни пункта в зависимостта си от въглища до 33% спрямо 31% през 2022 г. Китай направи крачка в намаляването на зависимостта си от най-мръсното изкопаемо гориво за производство на електроенергия, като търсенето в най-голямата икономика в Азия достига 60,7% през 2023 г. – по-малко от Индия (75,2%) и Полша (61%). Най-големият производител на въглища в света, Китай, постигна забележителен напредък в развитието на възобновяемата енергия. В резултат на това се наблюдава забавяне на темпа на увеличаване на емисиите - от средно 9% годишно между 2001 г. и 2015 г. до 4,4% годишен темп между 2016 г. и 2023 г., изтъква Ember, добавяйки, че чистото електричество е допринесло за 35% от общото производство на електроенергия в Китай. Индонезия и Филипините все още изостават при замяната на въглищата като основен източник на електроенергия, а увеличаването на възобновяемата енергия в техния микс е от първостепенно значение. Производството на вятърна и соларна енергия във Филипините се е увеличило само от по-малко от 1 тераватчас (ТВтч) през 2015 г. до 3,7 ТВтч през миналата година. Това е значително по-бавен темп от растежа в останалата част от региона, където генерирането на електроенергия от вятър и слънце се покачва с 46 ТВтч от 2015 г. до 2023 г. - главно благодарение на Виетнам. Източник: investor.bg

|

|

Индекси на фондови борси

03.07.2024 |

| Dow Jones Industrial |

| 39 295.00 |

(-7.00) |

| Nasdaq Composite |

| 18 188.30 |

(159.54) |

Стокови борси

03.07.2024 |

|---|

| |

Стока |

Цена |

|

| Light crude ($US/bbl.) | 83.17 |

| Heating oil ($US/gal.) | 2.4660 |

| Natural gas ($US/mmbtu) | 2.7380 |

| Unleaded gas ($US/gal.) | 2.6125 |

| Gold ($US/Troy Oz.) | 2 338.60 |

| Silver ($US/Troy Oz.) | 29.82 |

| Platinum ($US/Troy Oz.) | 1 012.20 |

| Hogs (cents/lb.) | 89.23 |

| Live cattle (cents/lb.) | 185.10 |

|

|

|

Велинград |

|

Велинград е град в Южна България, в област Пазарджик и е втори по големина в областта след областния град Пазарджик. Градът е създаден през 1948 г. със сливането на селата Лъджене, Каменица и Чепино, а от 1977 г. става общински център. Той е един от най-големите балнеологични курорти в България и е известен като „СПА столицата на Балканите“. Велинградското геотермално находище е най-голямото в Южна България. Сумарният дебит на изворите е 160 л/сек. Минералните извори (80 на брой), мекият климат и прекрасната природа са голямото богатство на града. Сред най-забележителните, романтични и тайнствени кътове на Велинград е изворът Клептуза, а едноименният парк с двете си езера е един от символите на града. Той се намира в квартал Чепино, който е една от трите термални зони във Велинград. Голяма част от изворната вода се използва за питейни нужди; другата част захранва две красиви езера, които след това се вливат в Чепинска река, а от нея – в Марица и Бяло море. Този природен феномен блика в основата на отвесна мраморна скала, покрита със зелен мъх. В зависимост от сезона и количеството на валежите на повърхността му избликват до 1180 л/сек, като средният дебит е 570 л ледено студена вода. Името на езерото идва от гръцки и означава “крия на тайно място” и вероятно е свързано с неочакваната поява на изворните води, сякаш са били заключени в подземния карст и са внезапно отприщени. За това истинско природно чудо се разказват легенди и предания, според които някога по тези места е живял Орфей. Паркът е изграден със собствени средства от бившата селска община с. Чепино – Баня, като първото езеро е установено през 1933 г. (Източник: bg.wikipedia.org)

Местоположение

|

|

Архив

Бизнес Индустрия Капитали |

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив