Business Industry Capital

До 31.08.2024 г. можете да ни помогнете да станем по-полезни за Вас!

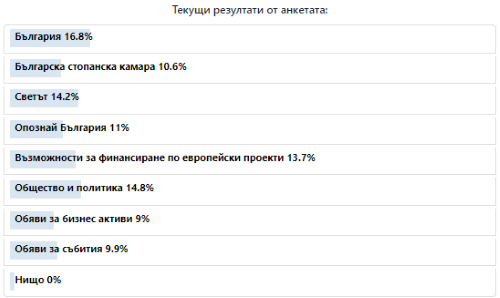

Кои рубрики на "Бизнес Индустрия Капитали" са най-интересни (полезни) за вас:

|

България

|

|  | |

|

Цена: 495 000 EUR

Имотът е на територията на бившия ПУРП Кремиковци АД с Дворно място (с площ 3684 кв. м), и ЕДНОЕТАЖНА АДМИНИСТРАТИВНА СГРАДА (с площ от 576 кв. м) с 26 помещения за канцеларии, две санитарни помещения и коридори.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Валутни курсове

(10.07.2024) |

|---|

| |

EUR |

|

1.95583 |

|

| GBP |

|

2.31484 |

| USD |

|

1.80861 |

| CHF |

|

2.01383 |

| EUR/USD |

|

1.0814* |

|

* определен от ЕЦБ |

|

ОЛП |

| |

от 01.07 |

|

3.63% |

|

|

Цена: 240 000 EUR

3 бр. съседни парцели, с обща площ 59583 кв.м. , нива 5-а категория (възможна промяна), в статут ПИ/поземлен имот.

Локация: срещу бензиностанция OMV (посока Варна) и до бензиностанция OMV (посока София), на около 65 км. преди гр.София

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Цена: 3 500 000 EUR

Сградата представлява монолитно строителство със сутеренно ниво, партер и шест офисни етажи. Разполага с подходящи помещения за банков офис с трезор на две нива (сутерен и партер) със ЗП 298,622 кв.м. и шест на брой офиси, разположени самостоятелно на етаж.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

|

|

Финансови новини |

|

Близо 586 хиляди фирми са подали годишни отчети за 2023 г. в Информационна система "Бизнес статистика" на Националния статистически институт (НСИ). Тази година подадените отчети са с 8711 повече спрямо предходната година, отчитат от националната статистика. В момента тече втори етап от кампанията, като до 30 септември 2024 г. фирмите и организациите могат еднократно да подадат коригиращ отчет. Само за първата седмица на юли вече са подадени 1106 коригиращи отчета, показва справка от ИС "Бизнес статистика" към 8 юли. Източник: БТА

Средният осигурителен доход в България за м.май е 1669,53 лв., съобщава Националния осигурителен институт (НОИ). Това показва повишение с 29,95 лв. спрямо април и с 36 лв. спрямо март. Средномесечният осигурителен доход за периода от юни 2023 г. до май 2024 г. е 1535,69 лв. и също нараства – с 20,29 лв. спрямо данните за април. Определеният средномесечен осигурителен доход за страната за посочения период служи при изчисляване размерите на новоотпуснатите пенсии през месец юни 2024 г., съгласно чл.70, ал. 3 от Кодекса за социално осигуряване, припомнят от НОИ. Източник: investor.bg

|

Дружества |

|

Българските договорни фондове запазват позицията си на атрактивна инвестиционна възможност. Акумулирайки парични средства от дребните, непрофесионални инвеститори, тези колективни инвестиционни схеми печелят, влагайки в диверсифицирани портфейли от различни финансови инструменти. Към момента 100 от договорните фондове у нас от общо 146 лицензирани от Комисията за финансов надзор са на печалба. А 20 от тези колективни инвестиционни схеми отчитат пред клиентите си и двуцифрена доходност. Най-висока е печалбата на „Компас Глобал трендс“ от портфейла на управляващото дружество „Компас Инвест“ АД, е осигурил печалба от 22.40%, съчетана с повишение на нетната стойност на активите. Фондът влага паричните си срудства в компании, чиито продажби ръст с по-големи темпове от средното ниво на пазара. Целта е да се идентифицират и да се инвестира във фирми с над 20% повишение на приходите на годишна база в сектори на икономиката, които също се намират във фаза на растеж. „Скай Финанси“, организиран от управляващото дружество „Скай управление на активи“ АД отчита 19.84% възвръщаемост, и ръст на нетната стойност на активите. Фондът е активно управляван и инвестира преимуществено в акции на европейски банки и финансови компании. Географски той е насочен към финансовия сектор на Централна и Източна Европа. “ПФБК Восток” носи на инвеститорите си печалба от 19.27 процента. Това е първият български договорен фонд, който инвестира в Русия и в страните от бившия Съветски съюз, и притежава диверсифициран портфейл от акции на руски компании. А вследствие на позитивното представяне на тези пазари през тази година активите на фонда са нараснали и вече са над 596 хил. лева. Той е първата “собствена” схема за “ПФБК асет мениджмънт” АД. Компанията управлява и три договорни фонда на “Първа инвестиционна банка” – “ПИБ Авангард”, “ПИБ Класик” и “ПИБ Гарант”, както и активите на национално инвестиционно дружество от затворен тип – НИД “Надежда” АД. „Адванс Източна Европа Клас “А”, организиран от „Карол капитал мениджмънт“ АД, показа доходност от 17.83% и повишение на нетната стойност на активите. Фондът осъществява активна инвестиционна политика като влага основно в акции на големи компании, включени в основните фондови индекси на регулираните пазари в Източна Европа. Стратегията му се основава най-вече на т.н. top-down подход, при който основното решение е по отношение на разпределението на активите между различни пазари. За клас „А“ основните пазари за фонда към момента са Гърция, Турция, Румъния и България. „ПИБ Авангард“ е глобален високодоходен фонд в акции. Той предлага достъп до активно управляван, диверсифициран портфейл от акции и финансови инструменти с висока доходност. Инвестициите на колективната схема не са ограничени от гледна точка на държава, пазарна капитализация или присъствие в индекс. Източник: Банкеръ

Държавният газов доставчик "Булгаргаз" заведе дело срещу руската компания "Газпром експорт" пред Арбитражния съд при Международната търговска камара в Париж, като иска обезщетение от над 400 млн. евро за вреди, претърпени в резултат на едностранното преустановяване на доставките на природен газ през април 2022 г. През май 2024 г. "Булгаргаз" ЕАД изпрати покана до "Газпром Експорт" за доброволно уреждане на претенцията съгласно договора между двете компании. Руската страна не е направила нищо за извънсъдебно разрешаване на въпроса. Размерът на претенцията е определен въз основа на правен и финансов анализ, в подготовката на който са ползвани услугите и на международни адвокатски кантори. Русия, която до началото на инвазията си в Украйна беше практически единствен доставчик на природен газ в България, спря внезапно подаването въпреки съществуващия договор и обяви страната за неприятелска. Източник: econ.bg

Българската марка "Флеар" (Flair) е изборът на БОК за спортна екипировка на олимпийците, които ще представят страната ни на летните игри в Париж 2024 (26 юли - 11 август). Хасковският производител ще достави целия набор от необходими артикули, с изключение на маратонките и саковете, които ще са произведени от японската компания "Асикс". Именно дистрибуторът на азиатския гигант за България - "Кей Дифужън" ООД, е фирмата, спечелила през 2022 г. обществената поръчка на олимпийския комитет за доставка на спортната екипировка за Париж. Съдружник във въпросната фирма с 20% участие е президентът на волейболната федерация (БФВ) и вицепрезидент на БОК Любомир Ганев. Останалите 80% са притежание на Паулина Първанова. От Япония обаче са информирали българската страна, че не се наемат да произвеждат специално брандирана продукция за толкова малка делегация, поради което е намерен своеобразен подизпълнител на част от поръчката в лицето на "Флеар Спорт" ООД. Общата прогнозна стойност на поръчката за екипировка възлиза на 243 600 лв. без ДДС, като от тях 81 000 лв. без ДДС струват 300 броя сакове и 300 чифта маратонки на "Асикс". Останалата част от офертата е за 300 комплекта тениски, гащета, анцузи, чорапи, якета, шапки и раници. Любопитното е, че официалното облекло на българската делегация за XXXIII летни игри ще бъде осигурено от фирма с основен предмет на дейност земеделие - "ВиКо Трейдинг" ЕООД. Регистрираното в София дружество е спечелило обществената поръчка на БОК през май 2024 г. с оферта от 145 000 лв. без ДДС за доставка на общо 900 модни артикула - по 100 броя мъжки и дамски якета, мъжки и дамски панталони, шапки и колани, както и по 200 броя мъжки и дамски блузи. Източник: Сега

ДЗЗД “ТРП Бургас 2023”, с водещ партньор “Пътстрой ВДХ” ЕАД с 50% дялово участие и “Трейс груп холд” АД – София – партньор с 50% дялово участие, подписа договор за поддържане и ремонтни дейности на републиканските пътища на територията на Югоизточен район, за обособена позиция № 1 – ОПУ Бургас. Възложител е Агенция “Пътна инфраструктура”, а договорът е на стойност 161 635 162 лева. Срокът за изпълнение е 48 месеца. Изпълнението на обществената поръчка включва текущ ремонт, текущо и преватнивно поддържане. В обществената поръчка се предвижда и зимно пъддържане на пътищата. Инженеринговата компания „Трейс Груп Холд“ АД приключи първото тримесечие на тази година с приходи (без финансови) на стойност 45.57 млн. лв., които нарастват с 653 процента в сравнение със същия период на миналата година. Източник: Банкеръ

Частен съдебен изпълнител е обявил продажбата на голяма производствена база на "Плантабул" ЕООД в с. Каспичан с начална тръжна цена от 2 238 432 лева. Семейната компанията е основана през 1999 г.и е специализирана в изкупуването, преработката и износа на диворастящи, култивирани и органични битки, сухи плодове, орехи и орехови ядки и билкови чайове. Тя притежава две фабрики - обявената за публична продан и друга, разположена в Шумен и предназначена за преработка на ядки. Компанията е най-голямата в България, съчетаваща всички процеси на събиране, преработка и износ на билки за фармацевтична, козметична и хранително-вкусова промишленост. Дружеството е изнасло 99% от лечебните изделия за ЕС и САЩ, като 15% от билките са сертифицирани като биопроизводство. Приходите на "Плантабул" за 2022 г. са 1,721 млн. лева - най-слабото представяне от 2008 г. до последната година, за която има данни. Печалбата е била 189 000 лева. Броят на осигурените лица от над 40 служители през 2020 г. намаляват към април 2024 г. до 10. Сега фабриката за преработка на билки в Каспичан отива на търг, след като фирмата е поставена под запор в полза на "Уникредит Булбанк", на която дължи 414 550 лева. Продават се 3 поземлени имота с обща площ от около 26 декара. Върху тях са построени 7 сгради, като от снимките се вижда, че те са в много добро външно състояние и даже на покривите са инсталирани соларни панели. Източник: money.bg

|

|

Българска стопанска камара

|

|  |

|

Светът

|

|  |

|

Европа |

|

Увеличението на броя на фалитите в Германия през първата половина на 2024 г. е 41% спрямо същия период на миналата година, съобщава вестник Handelsblatt, като се позовава на проучване на консултантската компания за преструктуриране на бизнеса Falkensteg. През първите шест месеца на 2024 г. 162 германски компании с оборот над 10 млн. евро са фалирали. Сред тях са известни компании, сред които големият производител на облекло Esprit и третият по големина европейски туроператор FTI. Това нарастване на броя на неплатежоспособните компании надхвърля прогнозите на експертите, които очакваха ръст на фалитите за този период от около 30%. За компаниите става все по-трудно да преструктурират бизнеса си, за да избегнат фалит. Така анализът на Falkenstag показа, че от 279 компании, подали молба за банкрут през 2023 г., само 35% са били спасени до края на първата половина на 2024 г. Сред причините за тази ситуация Handelsblatt посочва ефектите от пандемията от коронавирус, инфлацията , включително повишените цени на енергията и суровините, отслабването на потребителското търсене, както и несигурността, причинена от глобалните кризи и негативните прогнози за германската икономика. На 25 юни германската кредитна агенция Creditreform съобщи, че броят на фалитите в Германия през първата половина на 2024 г. е достигнал 11 000, най-високата цифра от почти десетилетие. По-рано Международният валутен фонд понижи прогнозата си за икономическия растеж на Германия с 0,3 процентни пункта до 0,2% през 2024 г. БВП на Германия е намалял с 0,3% през 2023 г. спрямо предходната година. Експерти от Германската федерална статистическа служба отбелязаха в края на миналата година спад в покупателната способност на населението поради покачването на потребителските цени. fakti.bg

Потребителските цени в страните от Организацията за икономическо сътрудничество и развитие (ОИСР) са се увеличили с 5.9% през май на годишна база, след нарастване от 5.7% през април. Стойностите, обаче, не надхвърлят границата от 6% от октомври 2023 г., казапа от бозираната в Париж организация. Темпът на повишаване на цените се ускори в 18 от 38-те страни от ОИСР. Най-значителното ускоряване е регистрирано в Дания (с 2.2% спрямо 0.8% през април), в Португалия (с 3.1% от 2.2%) и Турция (с 75.4% от 69.8%). Цените на енергията се повишиха с 2.5% през май (най-голямото увеличение от февруари 2023 г.) след спад от 0.1% през април. Цените на храните се повишават с 4.8% за трети пореден месец. Така ръстът на потребителските цени без разходите за храни и енергия (базисна инфлация) през предходния месец възлиза на 6.1% (през април – на 6.2%). Инфлацията в страните от Г-7 остана 2.9%, в страните от Г-20 се увели до 7.3% от 7.1% през април. Потребителските цени в еврозоната (HICP индекс) са нараснали с 2.6% през май в сравнение с 2.4% месец по-рано. Темпът на растеж на показателя без цените на храните и енергийните ресурси се ускори до 2.9% от 2.7%. Предварителните данни показват, че инфлацията в еврозоната е била 2.5% през юни.

|

Америка |

|

Международният валутен фонд (МВФ) ще обсъди преразглеждане на таксите, които налага на най-големите си кредитополучатели, след като някои държави изразиха опасения, че разходите стават необосновани поради по-високите лихвени проценти, предава Bloomberg. Таксите се прилагат за държави, които заемат повече от отпуснатия им дял или се нуждаят от повече време, за да изплатят заемите по програмите на МВФ. Промяната на политиката ще изисква 70% от гласовете на управителния съвет, за да бъде одобрена. Базираният във Вашингтон фонд събира таксите от години като начин да възпре най-големите си кредитополучатели да станат прекалено зависими от кризисния кредитор. Според данни на Центъра за икономически и политически изследвания таксите са напълнили хазната на фонда, но са довели и до допълнителни разходи в размер на милиарди долари за държавите, които вече са в затруднено положение. По-високите световни лихвени проценти, особено на Федералния резерв в САЩ и Европейската централна банка, означават, че общият лихвен процент по някои заеми от МВФ вече е по-висок от 8%. Това е два пъти повече от нивото преди пандемията от Covid-19. Тежестта се поема основно от няколко държави, сред които Аржентина, Египет и Украйна, като достига 6 млрд. долара. Фондът начислява лихва от 200 базисни пункта, или 2 процентни пункта, върху неизплатените заеми над 187,5% от нормалния достъп на дадена държава - известен като "квота" - до финансиране от МВФ. Тази ставка нараства до 300 базисни пункта, ако след три години заемът остане над този процент. Това е в допълнение към основния лихвен процент, който в момента възлиза на около 500 базисни пункта. МВФ заяви, че таксите са необходима част от неговия финансов модел, чиято цел е да възпрепятства вземането на твърде големи заеми или твърде дългото им изплащане. Кредитополучателите и техните поддръжници твърдят, че допълнителните такси изчерпват ресурсите, необходими за стоки от първа необходимост, като храна и здравеопазване, и са все по-рестриктивни предвид по-бързата инфлация и по-високите лихвени проценти. САЩ, които са най-големият акционер в МВФ, вече изразиха готовност да преразгледат таксите. Източник: investor.bg

|

Азия |

|

Въпреки широко разпространените прогнози за забавяне, растежът на глобалния брутен вътрешен продукт се ускорява. Съединените щати все още са водещият играч в световния екип, но вече се вижда, че други региони започват да набират скорост. Международният валутен фонд, Световната банка, Организацията за икономическо сътрудничество и развитие изразяват тревога, че световната икономика не е успяла да възвърне скоростта си на растеж отпреди пандемията. Както посочва Световната банка, през 2024 г. и 2025 г. близо 60% от страните, съставляващи над 80% от световното население, ще имат растеж по-малък от средния си темп през между 2010 и 2020 г. Анализаторите на UBS проследиха месечни данни от 28 икономики за април и установиха, че световната икономика расте с годишен темп от 3,5%. Ако този темп се запази през цялата година, той ще бъде от средният годишен ръст от 3,7% през десетилетието преди пандемията от Covid-19 да засегне световните икономики през 2020 г. Също толкова важно е, че този растеж идва на фона на забавяне на покачването на цените. Средната обща инфлация достигна своя връх от 9,4% през 2022 г., тъй като извънредната ситуация в областта на здравеопазването и мащабните локдауни доведоха до скок на цените по целия свят. Но след като веригите за доставки, енергийните пазари и поведението на потребителите се адаптираха, а централните банки, макар и със закъснение, агресивно повишиха лихвите, глобалната инфлация е на път да спадне до 2,8% тази година и 2,4% през 2025 г., прогнозира МВФ. За разлика от повечето други страни, САЩ вече възобновиха своята траектория на растеж отпреди пандемията, като се очаква БВП да нарасне с 2,7% тази година в сравнение със само 1,7% за напредналите икономики като цяло, показват данните на МВФ. Вярно е, че има признаци, че звездното представяне на най-голямата икономика е към края си. БВП на САЩ нарасна с годишен темп от само 1,4% през първите три месеца на годината, докато индексът на потребителските настроения, съставен от Университета на Мичиган, е на най-ниското си ниво от ноември 2023 г. В рамките на 28-те икономики, анализирани от UBS, импулсът на растеж идва от нововъзникващи пазари като Индия, Турция и Полша. Вътрешната икономика в тези и други страни дава голяма част от импулса, тъй като намаляващата инфлация и стабилните пазари на труда подтикват повече хора да харчат. Бумът на доверието на потребителите, например, ще задвижи индийската икономика до темп на растеж от 7,2% през 2024 г. и 6,5% през следващата година, според икономистите на Fitch. Това е много над средната годишна стойност от 4,6% между 2019 г. и 2023 г. След икономическата стагнация, причинена от високите цени на енергията и липсата на инвестиции, еврозоната се възстановява. Проучване на 5000 компании в региона на единната валута, проведено от S&P Global, установи, , че техните очаквания за ръст на производството през второто тримесечие на 2024 г. са били най-високи от една година. Дори Китай нарасна с годишен темп от 5,3% през първото тримесечие, което е много по-добър резултат от прогнозата от 4,6% в проучване на Ройтерс. Това стабилно начало на годината беше подпомогнато от фискалните и монетарни стимули от правителството. Надеждите на Китай да постигне обявената от Пекин цел от „около 5%“ растеж през 2024 г. са застрашени от продължителна имотна криза, анемично потребление и възможни търговски войни. Междувременно еврозоната успя да нарасне само с 0,4% на годишна база между януари и март. Политическата нестабилност, наблюдавана при изборите във Франция, по-слабата фискална огнева мощ поради нарастващата държавна задлъжнялост и по-слабият износ поради търговски проблеми, ограничават перспективите за растеж на региона. Инвеститорите в суровини са постигнали възвращаемост от близо 14% от инвестициите си в петрол от януари и зашеметяващите 22,5%, ако са купили сребро. Вярно е, че облигациите изпитват затруднения да генерират пари, но инвеститори, търсещи печалби от доходи, като пенсионни фондове и застрахователи, в момента могат да спечелят възвръщаемост от близо 4,5% върху 30-годишните държавни облигации на САЩ. Засега обаче световната икономика се движи в необичайно спокойни води, а инвеститорите имат вятър в платната си. manager.bg

|

|

Индекси на фондови борси

08.07.2024 |

| Dow Jones Industrial |

| 39 325.00 |

(-1.00) |

| Nasdaq Composite |

| 18 399.80 |

(46.87) |

Стокови борси

08.07.2024 |

|---|

| |

Стока |

Цена |

|

| Light crude ($US/bbl.) | 83.44 |

| Heating oil ($US/gal.) | 2.6200 |

| Natural gas ($US/mmbtu) | 2.3300 |

| Unleaded gas ($US/gal.) | 2.6200 |

| Gold ($US/Troy Oz.) | 2 399.80 |

| Silver ($US/Troy Oz.) | 31.53 |

| Platinum ($US/Troy Oz.) | 1 044.00 |

| Hogs (cents/lb.) | 89.88 |

| Live cattle (cents/lb.) | 186.43 |

|

|

|

Пещера Духлата |

|

Духлата е най-дългата пещера в България. Намира се в югозападните поли на Витоша, в околностите на с. Боснек, на около 45 мин. път с кола от София. Проучването на дългата повече от 18 км пещера започва още през 1965 г. и продължава и до днес. От пещерата са проучени около 15 км, като са открити над 50 невероятно красиви зали с варовикови образувания и езера. Духлата се състои от 6 пещерни нива и множество на брой тесни галерии, наречени тесняци, образуващи уникален лабиринт. Изработката на карта на този природен феномен е отнела десетки години на труд. Според едно от преданията, Ал.Стрезов сънува части от т.нар. “Академишка духла” още преди те да бъдат открити. Друга легенда гласи, че пътят през “Гърлото на ада” е показан на пещерняците от ято прилепи, които вкупом излетели оттам и във вихъра на крилата им угаснали всичките карбидки. Природната забележителност “Духлата” с разнообразните си сталактитни и сталагмитни образувания, балдахини и драперии, езерца и пр. се смята за една от най - красивите пещери у нас.

Местоположение

|

|

Архив

Бизнес Индустрия Капитали |

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив