Business Industry Capital

До 31.08.2024 г. можете да ни помогнете да станем по-полезни за Вас!

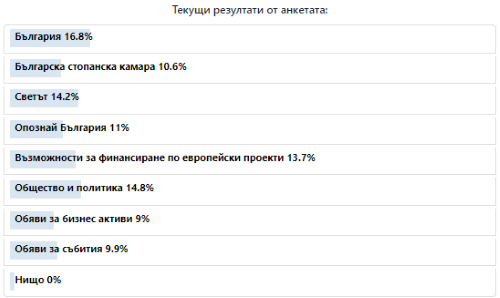

Кои рубрики на "Бизнес Индустрия Капитали" са най-интересни (полезни) за вас:

|

България

|

|  | |

|

Цена: 495 000 EUR

Имотът е на територията на бившия ПУРП Кремиковци АД с Дворно място (с площ 3684 кв. м), и ЕДНОЕТАЖНА АДМИНИСТРАТИВНА СГРАДА (с площ от 576 кв. м) с 26 помещения за канцеларии, две санитарни помещения и коридори.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Валутни курсове

(27.06.2024) |

|---|

| |

EUR |

|

1.95583 |

|

| GBP |

|

2.31588 |

| USD |

|

1.82976 |

| CHF |

|

2.04051 |

| EUR/USD |

|

1.0689* |

|

* определен от ЕЦБ |

|

ОЛП |

| |

от 01.06 |

|

3.78% |

|

|

Цена: 240 000 EUR

3 бр. съседни парцели, с обща площ 59583 кв.м. , нива 5-а категория (възможна промяна), в статут ПИ/поземлен имот.

Локация: срещу бензиностанция OMV (посока Варна) и до бензиностанция OMV (посока София), на около 65 км. преди гр.София

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Цена: 460 000 EUR

Офисът е с 8 помещения - приемна, 6 работни помещения, конферентна зала, кухня и сервизни помещения. Застроена площ 212,44 кв. м. Сградата е с асансьор, видеонаблюдение и контролиран достъп.

Обектът е подходящ за представителен офис, а заради близостта до Софийски градски съд и за адвокатска или нотариална кантора.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Цена: 4 144 000 EUR

(Текуща пазарна стойност на обекта по оценка на лицензиран оценител – 4 209 466 EUR)

3 халета (с обща площ 1600 кв.м и височина 11 м.), кранове за товарно-разтоварна дейност (подемност 13 т.). адм. сграда (360 кв.м), складове и действащ магазин с индустриална насоченост.

Съветите на експерта

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

Цена: 3 500 000 EUR

Сградата представлява монолитно строителство със сутеренно ниво, партер и шест офисни етажи. Разполага с подходящи помещения за банков офис с трезор на две нива (сутерен и партер) със ЗП 298,622 кв.м. и шест на брой офиси, разположени самостоятелно на етаж.

Контакти:

0888 924185 0888 924185

sfb@bia-bg.com sfb@bia-bg.com

|

|

Финансови новини |

|

Ръстът на кредитите леко се забавя през май обемът на отпуснатите кредити в България вече надхвърля 21.8 млрд. лв., като ускорението на годишна база е с 24.45% - което е и нов най-бърз темп на увеличение от 2009 г. Само за май скокът е с нови близо 410 млн. лв., като за трети пореден месец номиналният растеж е с по над 400 млн. лв., а отбелязаните 463 млн. лв. през април са абсолютен рекорд, показват данните от от паричната статистика на БНБ. Основен двигател на ипотечния бум остава изобилната ликвидност в сектора, която задържа изключително ниски лихвите и по кредити, и по депозити. Същевременно, макар и Европейската централна банка да започна да затяга паричната си политика преди няколко месеца, ефектите от това на практика не се усещат на българския пазар, като дори в корпоративния сегмент, където по-голяма част от заемите са обвързани с европейския индекс EURIBOR, темповете на растеж на кредитирането остават високи. През май статистиката отчита 8.42% годишен ръст на фирмените заеми до нов номинален рекорд от 45.6 млрд. лв. Макар и само за последния месец повишението да е "едва" 100 млн. лв. спрямо над 460 през април, тенденцията остава възходяща, като от февруари годишното ускорение в обемите трайно е с по над 8%. Друг запазващ се тренд е този на подчертания ръст на овърдрафта, който достига 16.2 млрд. лв. Паралелно със затягането на политиката на ЕЦБ българският регулатор също опита да сложи известна спирачка на пазара, като през 2023 г. повиши задължителните минимални резерви на банките от 10 на 12%. Тази мярка обаче не успя да изтегли достатъчно ликвидност от системата, така че да доведе до осезаем ефект за охлаждането на кредитирането. Така само от началото на настоящата година ипотечните портфейли на банките са нараснали с 1.9 млрд. лв., а за последните 12 месеца увеличението е с близо 4.3 млрд. лв. Обемът на потребителското финансиране през май расте с 215.6 млн. лв. и почти достига 18 млрд. лв., като бележи поредна рекордна стойност. На годишна база ускорението е с 13.93%, или съвсем малко под отбелязаните през април 14.05% - подобни стойности бяха достигнати и преди около година и половина, в края на 2022 г., след което последва леко охлаждане до около 10.5%. Сумарно за банковата система годишният ръст на кредитирането за май е 13.12%, минимално под отчетните месец по-рано 13.13%, а ускорението от началото на 2024 г. говори, че при още няколко силни месеца може да бъдат надскочени нивата около 13.5%, достигнати през лятото на 2022 г. Висока остава и ликвидността в системата - депозитите на домакинствата достигат 82.8 млрд. лв., като нарастват с 11.7% на годишна база през май (11.1% ръст месец по-рано). При вложенията на бизнеса ръстът леко се забавя до 6.7% за последния месец спрямо 7.4% през април, а в номинално изражение обемът достига 43.8 млрд. лв. Общо за неправителствения сектор увеличението на средствата в банките е с 9.3% за май (8.9% месец по-рано) до 129.9 млрд. лв. По данни на Национален статистически институт в регион София-град през предходната година са платени най-високите локални данъци и такси. Най-високо над междинните за страната са ставките върху търговията на дребно – 20 лв. на квадратен метър комерсиална площ, при приблизително 13 лв. за страната. На второ място се подрежда област Варна. Данъкът върху транспортните средства е най-голям в Бургас. Областите с най-ниски налози са Монтана и Видин, където налога върху търговията на дребно е 3 пъти по-нисък от междинния за страната. Най-високи са локалните налози в туристическата община Созопол. През миналата година от НСИ регистрират и смяна в броя на обитаемоте места у нас. Сумарно те са малко над 5250, като градовете са 257, а селата 4999. В близо една трета от всички тези села живеят под 50 души, а обитаемоте места без нито един гражданин са 201. Най-голяма част от тях се намират в областите Велико Търново и Габрово. В България има 28 области и 265 общини. Най-голямата по територия област е Бургас, а най-малката – София-град. Трите най-големи града у нас са и единствените разграничени на рейони. Столична община се дели на 24, Пловдив – на 6, а Варна – на 5 района. 1/6 от жителите на Столична община живеят в два от районите - „ Люлин ” и „ Младост ”, като всеки един от тях наброява над 100 хиляди души. Източник: NovaTV

|

Дружества |

|

Pulse - лидер в сферата на спорта и здравето, придоби чрез покупко-продажба от Лидл България, терен от 9,8 декара на бул. „Президент Линкълн“ в кв. Овча купел на гр. София. Очаква се новият комплекс да отвори врати през 2025 година. Проектът предвижда изграждането на най-големия клуб от веригата – 5 етажна сграда с обща площ от 6500кв.м. Новият клуб от веригата на ще допринесе за развитието на района предлагайки на жителите на кв. Овча Кучел и околните най-висококачествена услуга за спорт и релакс. Комплексът ще бъде с паркинг с капацитет над 400 места, което ще осигури максимално удобство за посетителите. Новият клуб ще е с басейн, луксозен СПА център със зони за релакс, иновативна и просторна CrossRX зала, мултифункционална зона с модерни уреди, силова зона за развитие на мускулна маса и сила, както и просторни зали за групови тренировки. Според основателят на Pulse Паскал Дойчев, общата инвестиция възлиза на 14 милиона лева. Най-голямата и най-успешна верига лайфстайл фитнес клубове в България вече разполага с 21 локации. Източник: 24 часа

Открит е първия китайски хотел в София - "Аурора София", който се намира на ул. "Българска морава" 40, в близост до двата големи булеварда "Тодор Александров" и "Ал. Стамболийски", метростанция "Опълченска" и Mall Sofia. Хотелът е тризвезден, бутиков и е насочен към бизнес клиентите. Официално започва да работи на 28 или 29 юни, като се чака удостоверение за категоризация. Приблизително инвестицията е около 4.5 млн. лв., казва Пейо Mайорски, мениджър на хотела. Компанията - инвеститор в сградата, е "Тиенджин турист". Компанията инвеститор "Тиенджин турист" е с капитал 4 млн. лв. Тя е с трима китайски собственици, физически лица. Мажоритарен собственик е Йе Боджан, като другите двама са Жианг Жингюн и Лиу Чунюнг. Пейо Майорски, който е и председател на Асоциацята за защита на потребителите, работи с китайските си партньори от 2012 г. през туристическата агенция China Travel Company. До миналата година в нея има и китайско участие - през март 2023 г. Лиу Чунюнг излиза като съдружник от "Чайна травъл къмпани". Китайските инвеститори в хотела се занимават с различни бизнеси в България, предимно в земеделието и по-специално произвеждат фуражи, като продукцията е насочена основно за Китай. Жианг Жингюн и Лиу Чунюнг са съдружници в "България Тианшинонг Фийд ко.", компания с капитал 13.8 млн. лв., която през 2016 г. започна строителството на фуражен завод в Добрич. Към последната година с отчет - 2022 г., все още фирмата е с минимални приходи. "Аурора София" разполага с 27 стаи с тераси и 3 семейни апартамента. Изградени са още външна градина, подземен паркинг, конферентна зала, лоби бар и ресторант. Десетки нови служители планира да наеме myPOS в България, като си поставя за цел през системите ѝ през 2024 г. да минат транзакции за над 14 млрд. евро - двуцифрен растеж. 500 от 700-те служители на myPOS в Европа работят в България. През 2023 г. компанията е увеличила екипа си с 27%. Към момента myPOS има над 45 активни обяви за нови работни места в България. Създадената в България финтех компания, която беше придобита от американския инвестиционен фонд Advent International, вече 10 години предлага цялостно решение за приемане на картови плащания за бизнеса на повече от 35 европейски пазара. Използват я повече от 200 000 търговци. Източници на "Ройтерс" оценяваха сделката за myPOS на около 500 милиона евро. Източник: money.bg

Учредяването право на строеж в общински имот, който се намира в бизнес зона „Перистър“, подкрепиха общинските съветници в Разград. За терена има заявено намерение от потенциален инвеститор за изграждане на цех за производство на електронни компоненти. Размерът на инвестицията е 1 500 000 лв., а разкритите работни места ще бъдат не по-малко от 12. Източник: БНР

Частен съдебен изпълнител прави пореден опит за продажба на СПА хотел Беркут. Имотът включва 18 еднофамилни къщи, спортен комплекс с ресторант и вътрешен плувен басейн. Началната цена на публичната продан е 6 418 070.21 лв., което е с близо 400 000 лв. по-малко от предходната. Собственик на имота и длъжник по изпълнителното дело е „Спорттур“ ЕООД, което е под шапката на "К-И Инвест холдинг" ЕООД. Върху хотела има наложени тежести. Той е ипотекиран в Българо-американската кредитна банка /БАКБ/. Първият опит за продажба на имота бе през 2019 г. Тогава стартовата цена бе 4 811 961 лв. Пет години по-късно стойността се завиши многократно заради включените 18 сгради. ЧСИ отделно обяви търг и на десетина товарни автомобила, собственост на „Кавен Ирадис“ ЕООД. Източник: Марица

Акционерите на „Илевън Кепитъл“ АД са гласували на общото събрание, което се е провело на 25 юни, брутен дивидент в размер на 0,6 лева на акция. Нетният дивидент на акция възлиза на 0,57 лева. Общата сума, която ще бъде изплатена на акционерите, възлиза на почти 1,4 млн. лева. Остатъкът от печалбата за 2023 г. в размер на над 9,3 млн. лева е отнесен като неразпределена печалба. Дивидентът ще се изплаща чрез инвестиционните посредници и „Уникредит Булбанк“ АД. Акционерите са гласували и промяна на устава, според която „Илевън Кепитъл“ става безсрочно дружество. Първоначално дружеството беше учредено със срок, който изтече в началото на 2024 г. и преди това беше удължен с две години. Източник: investor.bg

„Шелли Груп“ АД увеличи капитала си от 18 050 945 лв. на 18 105 559 лв. чрез публично предлагане на 55 331 броя акции при условия, определени от общото събрание на акционерите на 4 юни. В срока между 12 и 21 юни по набирателната сметка на дружеството са били записани и е била изцяло заплатена емисионната стойност на всички заявени за записване общо 54 614 броя нови акции от увеличението на капитала му в размер на 1 лева на акция. Емисионната стойност е 1 лв. за акция. Годишното общо събрание на акционерите на “Шелли Груп” прие предложението на съвета на директорите и одобри брутен дивидент в размер на 0.13 евро на акция. Общата сума от приблизително 2.3 млн. евро ще бъде разпределена от неразпределената печалба в рамките на 60 дни от датата на годишното общо събрание. „Шелли Груп“ АД е технологичен холдинг, който се занимава с иновации чрез разработване, производство и дистрибуция на висококачествени продукти за интернет на нещата. Групата се състои от 6 дъщерни дружества и има офиси в България, Германия и Слов Източник: Банкеръ

|

|

Обучение по методиката на REFA-Германия

за адаптиране организацията на

производството към световен опит, доказан в

практиката и избран от лидерите в индустрията. |

07.10-08.11.2024 07.10-08.11.2024  гр. София гр. София |

02/9814567, 0888924185 http://refa.bia-bg.com/ 02/9814567, 0888924185 http://refa.bia-bg.com/ |

|

|

Българска стопанска камара

|

|  |

|

Светът

|

|  |

|

Европа |

|

България не отговаря единствено на критерия за ценова стабилност, за да стане член на еврозоната. Това се посочва в двугодишния Конвергентен доклад на Европейската централна банка (ЕЦБ), който отразява готовността на всяка една от шестте страни от ЕС, които все още не са членки на еврозоната, да приемат еврото. Със средногодишна стойност на хармонизирания индекс на потребителските цени от 5,1 на сто България има "среден темп на инфлация доста над референтната стойност от 3,3 на сто" в периода от юни 2023 до май 2024 г. В своя доклад ЕЦБ посочва, че референтни държави по отношение на инфлацията са Дания (с хармонизирана инфлация от 1,1 на сто, Белгия (1,9 на сто) и Нидерландия (2,5 на сто). Финландия (с хармонизирана инфлация от 1,9 на сто) е изключена от референтните държави заради корекции в статистическата й методология, засягащи определянето на цените на електроенергията в страната. Критериите за присъединяване на дадена страна от ЕС към еврозоната, наред с инфлацията, са още нивото на бюджетния дефицит, на държавния дълг и на дългосрочния лихвен процент. Други две ключови изисквания са минимален престой от две години във Валутно-курсовия механизъм ЕРМ 2 (с допустимо максимално изменение на валутния курс от 15 на сто) и синхронизиране на националното законодателство с това, регламентиращо функционирането на Евросистемата (ЕЦБ и централните банки на страните от еврозоната). В доклада, освен България, са анализирани още Полша, Румъния, Унгария, Чехия и Швеция. Освен критерия за инфлацията България изпълнява всички други изисквания, отчита ЕЦБ. Страната ни е единствената нечленка на еврозоната, която постига това, както и единствената сред шестте, въвела към момента механизма ЕРМ 2.

Инфлацията

През май 2024 г. средният 12-месечен темп на хармонизираната инфлация в България е 5,1 на сто, т.е. доста над референтната стойност от 3,3 на сто, определена като критерий за ценовата стабилност. Разходите за труд на единица продукция са нараснали с 27,4 на сто през периода от 2020 г. до 2023 г., което е доста над нивото в еврозоната от 9,5 на сто. Има опасения относно устойчивостта на конвергенцията (сближаването) на инфлацията в България (с тази на еврозоната) в дългосрочен план. Процесът на догонване (на доходите, покупателната способност и др. показатели) вероятно ще доведе до положителни инфлационни разлики спрямо еврозоната, тъй като брутният вътрешен продукт (БВП) на човек от населението и ценовите равнища все още са значително по-ниски в България, отколкото в еврозоната. Ръстът на възнагражденията трябва да е обвързан с повишаване на производителността, което да прави страната привлекателна за инвестиции. За привличането на капитали е необходимо и изпълнение на "ангажимента на България за по-нататъшно намаляване на корупцията, осигуряване на независима и ефективна съдебна система и подобряване на образователната система", отбелязват анализаторите на ЕЦБ.

Ниво на бюджетния дефицит и държавния дълг

В момента България не е обект на решение на Съвета за наличие на прекомерен дефицит. Държавният бюджетен дефицит на България е 1,9 на сто от БВП през 2023 г., т.е. доста под референтната стойност от 3 на сто. В периода 2021-2023 г. балансът на държавните финанси се е подобрил, но отчетените дефицити остават над характерните за периода преди пандемията от КОВИД-19. Същевременно съотношението дълг/БВП е 23,1 на сто или също значително под референтната стойност от 60 на сто. Към 2023 г. обаче то е нараснало с 3,1 процентни пункта спрямо нивото от 2019 г., според ЕЦБ.

Стабилност на валутния курс, участие в ЕРМ 2 и "сивия списък" на Специалната група за финансови действия

Българският лев участва във валутния механизъм ЕРМ 2 през двугодишния референтен период от 20 юни 2022 г. до 19 юни 2024 г. През референтния период левът не показва отклонение от централния курс. В доклада се припомня, че споразумението за участие в ЕРМ 2 се основава на редица политически ангажименти, поети от българските власти. В момента България работи по тях и страната ни "е насърчавана да ускори усилията си за изпълнение на елементите на плана за действие, който беше приет от Специалната група за финансови действия (FATF), след като България беше поставена в "сивия списък" на групата за юрисдикции под засилено наблюдение, свързано с прането на пари, през октомври 2023 година".

Ниво на дългосрочните лихвени проценти

През референтния период от юни 2023 г. до май 2024 г. дългосрочните лихвени проценти в България са средно 4,0 на сто - под референтната стойност от 4,8 сто по критерия за конвергенция на лихвените проценти. Въпреки това разликата между дългосрочните лихвени проценти в България и лихвените проценти в еврозоната (претеглени спрямо БВП) в края на референтния период възлиза на 0,9 процентни пункта. България е единствената сред шестте, обхванати от доклада, в която тази разлика се увеличава. Тези тенденции "вероятно са свързани с риска за страната, произтичащ от политическата нестабилност", посочва ЕЦБ. В анализа се отбелязва, че капиталовите пазари в България остават по-малки и много по-слабо развити от тези в еврозоната.

Синхронизиране на законодателството

Българското законодателство е съвместимо с Договорите и Устава на ЕЦБ, както се изисква съгласно член 131 от Договора за функционирането на Европейския съюз, се отчита в конвергентния доклад. По-задълбочено внимание се отделя на промените в Конституцията, приети от 49-ото Народно събрание, с които се предвижда при назначаване на служебно правителство президентът на страната да избира служебен министър-председател измежду десет представители на различни институции, включително управителя и подуправителите на Българската народна банка (БНБ). В доклада се посочва, че за да се избегне конфликт на интереси и за да няма намеса в дейността на централната банка, ако управителят или някой от подуправителите на БНБ поемат поста на служебен министър-председател, то той трябва да подаде оставка от позицията си в БНБ.

Състояние на банковия сектор

В доклада на ЕЦБ се отбелязва работата в близко сътрудничество между БНБ и ЕЦБ, участието на страната ни в Банковия съюз, Единния надзорен механизъм и др. Отчитат се действията и на централната ни банка за охлаждане на кредитирането чрез повишаване на задължителните минимални резерви на банките. Източник: БТА

|

Америка |

|

Политиката за теглене на заеми в САЩ се е променила през годините, но виждаме система в криза – голяма държава, с огромна икономика, с големи национални и международни задължения, от една страна, а от друга страна има неефективност в разходите, както и грешки в управлението и няколко големи кризи. Този коментар Андрея Стоянович, финансов репортер във FINBOLD – платформа, която предоставя широко покритие на новини от различни финансови пазари. Проучване на Finbold твърди, че американският дълг е нараснал с 26,3 трлн. долара за последните 15 години след като правителствените разходи на САЩ са раздути във всички сфери. Докладът проучва как политиката на теглене на заеми в САЩ се е променяла през годините, започвайки от реформите на Роналд Рейгън. Изследването цели да разобличава вкоренена неефикасност в системата, говорейки за раздути правителствени разходи. Стоянович определя фискалните политики на САЩ като недостатъчни заради безразборното харчене. Той съобщи, че според проучването 2024 г. се очертава като втората най-лоша година за националния дълг на САЩ, като се изключат кризисните години. „Ако бъдат следвани сегашните трендове на централните банки, то може да говорим за истинска криза, която ще изисква големи ограничения", предупреди Андея Стоянович и обясни, че е възможно да има т.нар. разминаване между предполагаемата стойност и реалната стойност в системата. "От друга страна – това е малко противоречиво – през последните няколко години има признаци, които показват, че Фед и американското Министерство на финансите поне отчасти са приели постулатите на модерната теория на парите. В този случай обаче това не означава нищо – просто дългът ще продължи да расте“, допълва той. Според него малко вероятно е да се стигне до фалит, но проблемите най-вероятно ще доведат политически хаос със себе си, който ще изиграе съществена роля в предстоящите президентски избори. Американският дълг е по-различен от този на много от развиващите се икономики, тъй като огромна част от него се държи от граждани, фондове, пенсионни планове и други държави. „Ако разглеждаме историята на предходния мандат на Доналд Тръмп, то прогнозите сочат, че ако републиканецът се завърне в Белия дом, може да видим увеличение на задлъжнялостта. Според изследване Законът за намаляване на данъците и работните места, приет през 2017 г. по време на мандата на Тръмп, е довел до голямо нарастване на задълженията“, съобщи Стоянович.

Той смята, че при президентски мандат на Тръмп, ако действието на Закона за намаляване на данъците и за работните места на САЩ бъде удължено или дори данъчните облекчения да станат по-големи, вероятно ще се наложи да се теглят още заеми и държавният дълг ще расте. Стоянович смята, че има промяна в парадигмата, като преди финансовите пазари са били свързани с общото състояние на американските граждани и икономика. Докато сега се вижда, че концентрацията на богатството от финансовите пазари се държи от малък процент хора, посочи той и обясни, че именно тази малка група изключително богати хора са много добри в това да плащат по-малко данъци. "Дългът се повишава не защото не се плащат данъци – точно обратното. Населението плаща данъци, но след това заема пари на американското правителство, под формата на бонове, облигации и т.н., защото американското правителство се нуждае от парите“, коментира той. Един от въпросите, които проучването задава, е дали САЩ са се превърнали в заложник на своя дълг. Стоянович вярва, че в северноамериканската страна това се случва, но по-важното е как тя да излезе от тази ситуация. По думите му, това може да се постигне с ръст на продуктивността, изключителни ограничения, които „ще имат такива последствия за обществото, че ще ги превърнат в не толкова постижимо решение“. „Или ще изисква нов подход, който да използва американското правителство, както за ядрена алтернатива, например“, добави Стоянович. Той отбеляза, че вече се поставя и въпросът дали има нужда от преразглеждане на дълга, тъй като, от една страна, той дава влияние на САЩ. „Много международни играчи притежават част от него и те имат интерес от добре представяща се американска икономика“, отчете Стоянович и даде пример със страни като Саудитска Арабия и Китай, които ще изгубят много, ако нещо се случи с икономиката на САЩ. Той смята, че големият въпрос остава - как данните около задълженията ще бъдат използвани в предизборната кампания. Източник: investor.bg

|

Азия |

|

Вековната мечта на Индия да свърже многобройните си реки за премахване на водните кризи най-накрая се осъществява. Националният проект за свързване на реки (NRLP) може да реши дългогодишните проблеми на страната с наводненията и сушите, като предложи иновативен подход за преразпределяне на водните ресурси. Индия, страна на контрасти, където изобилието на вода в някои региони е придружено от сериозен недостиг в други, отдавна търси начини за справедливо разпределение на своите водни ресурси. NRLP е мрежа от приблизително 3000 резервоара, свързващи 37 реки, които ще пренасочат водата от излишните басейни към тези, където е най-необходима. Свързването на реките на Хималаите с реките на Арабско море и Бенгалския залив представлява инженерен подвиг, който ще преобрази пейзажа на Южна Азия. Изграждането на 30 тръбопровода, способни да пренасят 200 милиарда кубически метра вода годишно, обещава да подпомогне производството на водноелектрическа енергия и напояването на селското стопанство, което прави проекта не само екологичен, но и икономически жизнеспособен. ъпреки оптимизма, проектът предизвиква опасения сред учените, които предупреждават за потенциални непредвидени последици, като въздействието върху сезоните на мусоните. Tejasvi Chauhan от германския Институт за биогеохимия Макс Планк подчертава, че речните системи са взаимосвързани и промените в една могат да доведат до промени в друга. Стойността на проекта се оценява на 168 милиарда щатски долара. Първата връзка от мрежата, свързваща реките Кен и Бетва, вече е одобрена за изпълнение от правителството на Индия. Cash.bg

|

|

Индекси на фондови борси

26.06.2024 |

| Dow Jones Industrial |

| 39 142.00 |

(20.29) |

| Nasdaq Composite |

| 17 736.20 |

(18.86) |

Стокови борси

26.06.2024 |

|---|

| |

Стока |

Цена |

|

| Light crude ($US/bbl.) | 80.78 |

| Heating oil ($US/gal.) | 2.5287 |

| Natural gas ($US/mmbtu) | 2.7380 |

| Unleaded gas ($US/gal.) | 2.5287 |

| Gold ($US/Troy Oz.) | 2 331.70 |

| Silver ($US/Troy Oz.) | 28.92 |

| Platinum ($US/Troy Oz.) | 987.60 |

| Hogs (cents/lb.) | 89.00 |

| Live cattle (cents/lb.) | 184.43 |

|

|

|

95 г. от рождението на художника Доньо Донев |

|

Доньо Донев е роден на 27.06.1929 г. в Берковица. Завършва графика в Художествената академия през 1954г., а през 1959г. специализира в Союзмултфилм в Москва. Първият му анимационен филм като художник е „Грух и Грушка”(1957), а с „Дует”(1961) дебютира и като сценарист и режисьор. (За „Дует” е отличен на кино фестивалите във Варна (1962) и Виена (1964)). През 1998г. застава и от другата страна на камерата, като актьор във филма „Вагнер”. Работил е като художник във в. „Вечерни новини”(1954-1956), художник и режисьор в отдела за мултипликационни филми в СИФ(1956-1970) и в САФ „София”(1970-1993), където е и ръководител на творчески колектив. Доньо Донев е „бащата” на емблематичните „Трима глупаци”, които се появяват през 1970г. и преминават през годините през множество роли. Спечелил е общо 14 български и международни престижни награди за творчеството си. Донев умира на 28 ноември 2007 г. на 78 г.

|

|

Архив

Бизнес Индустрия Капитали |

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив

Последен брой

Последен брой

Абонамент

Абонамент

Анализи и коментари

Анализи и коментари

Опознай България

Опознай България

Публикации

Публикации

English

English

Архив

Архив